FAQs

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

The price an insurance company charges for coverage, based on the frequency and cost of potential accidents, theft and other losses. Prices vary from company to company, as with any product or service. Premiums also vary depending on the amount and type of coverage purchased.

An excess is the first part of each and every claim or loss which is excluded or the amount of the claim which is deducted from each claim. That amount of the loss is born by the insured. Either a specified dollar amount or a percentage of the claim amount.

Deductibles on the other hand is a very large excess and it is common to see the word deductible rather than excess in commercial policies and home owners polices, whereas a number of you who have vehicle insurance would see the word excess. Nowadays, however, it is common to find the terms being used interchangeably.

Information that would affect an insurance company's willingness to accept a policy, or the premium it would charge. Failing to disclose a material fact could invalidate a policy. Typical examples include previous driving convictions or a history of subsidence in a house.

An insurance policy is a contract between you and an insurance company, in which the company promises to take over the financial costs of certain risks. The policy describes the item(s) covered, the risks you are covered against and specifies your rights and responsibilities, along with the terms and limits of the cover.

For an event to be insurable its happening must be accidental and not deliberate on the part of the insured. An example of a non-fortuitous event or loss is an insured intentionally setting his or her home on fire. The event must be fortuitous as far as the insured is concerned.

Indemnity is the legal principle that the policyholder should be restored to the same financial position that they enjoyed prior to a loss occurring. There are a number of options opened to an insurer which will provide the policyholder with the necessary indemnity and these are:-

- Cash Payment

- Repair

- Replacement

- Reinstatement

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

Your Certificate of Insurance, Cover Note or Policy Schedule provides detailed information on the person(s) permitted to drive. There are, at times, limitations on the age and driving experience your drivers should have. Please look out for these.

Your vehicle is a prized possession, be selective about the persons you allow to drive it. A careless driver could cause your premiums to increase.

This is a discount you earn for not making a claim under your policy. As long as you do not make a claim it increases annually until it reaches a maximum percentage. It is important to note that even if you are not at fault in an accident, once you have made a claim, your discount will be reduced. It will be reinstated if we recover our expenditure.

Accident free driving is the best way to keep your premiums at a reasonable level.

Your No Claim Discount is not transferable to another person. However, you can transfer it from one of your vehicles to another one owned. However, it is not automatic that upon the purchase of the second vehicle you will get the same No Claims discount.

If you decide to modify your car to make it more powerful or faster we need to know. Unfortunately, such modifications increases the risks associated with your car and consequently the premiums.

No. The Law specifically prohibits us from granting you a grace period. Your cover expires at midnight on the date stated on your Certificate of Insurance. Therefore, if the day after the expiration of your cover is a weekend or Public holiday you must ensure your cover is renewed early.

You could restrict the driving of your vehicle to two named persons.

If you insure all your vehicles with one insurer you will be entitled to other vehicle discounts. And you can simply maintain a good driving record.

6. Why Motor Insurance?

Under the Motor Vehicles Insurance (Third Party Risks) act of 1988, a minimum level of insurance is compulsory if you intend to operate a vehicle on the St. Lucian roads. Being caught driving a vehicle that is not insured is an offence.

In addition, it is in your best interest to ensure that whether through someone else’s fault or yours an accident or loss does not cause you financial hardship.

Insuring your vehicle is a means of protecting yourself.

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

Some policies will pay for temporary housing if a hurricane makes your dwelling uninhabitable and the damage is caused by a covered peril. Most policies also will cover reasonable expenses for removal of debris and architects and surveyors fees. However you must request these additional benefits and there is usually an additional premium attached. Speak with your insurance company or broker regarding this cover.

You will only receive compensation for damaged furniture and other contents in your private dwelling if you have insured these and therefore they are insured by the company. Depending on the policy, coverage may pay for a new replacement item, or payments may be reduced based on the item's depreciation.

Damage to motor vehicles is not covered by a homeowner’s policy. Hurricane damage, including flooding damage, will be covered by your automobile insurance, provided your policy has ''comprehensive'' coverage.

Homeowners rates usually won't go up following a single hurricane. Rates are based on property insurance payments within the territory over the past several years, plus an amount held in reserve for a hurricane or other catastrophic event. Rates usually will be increased only after a series of large catastrophic loses that depleted this reserve. A homeowner's policy is not likely to be cancelled solely because of a hurricane. Companies could decide against continuing a policy if there were hazards on the property that aggravated the damages, such as dead trees or a faulty roof, and if there had been other losses on the policy in recent years.

- Immediately report all these incidents to the police and the Fire service, in case of fire.

- Where a crime has been committed do not tamper with any potential evidence before the arrival of the police

- Take photos where possible to show entry, exit and damage

- Contact our Claims Department or your broker representative as soon as possible List all damage / loss to building and contents.

- Locate and secure you insurance policy and any other personal contractual documents.

- Take photos of damage

- Secure premises with board, tarpaulins etc. to prevent further loss or damage to building and contents

- Keep all invoices and receipts for sums spent in securing the premises

- Contact our Claims Department or your broker representative as soon as possible for guidance

- Clean up debris Salvage as much as possible.

- Dry out electrical items, clothing etc.

- If necessary, use a generator to run essential electrical appliances e.g. freezers

- If the premises are rendered uninhabitable, seek reasonably priced temporary alternative accommodation. There is some coverage under your policy.

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

The Livelihood Protection Policy (LPP) is targeted at all individuals and you are eligible regardless of your annual income or means of employment. To buy, contact your Credit Union or call EC Global Insurance Agency at 451 3244 or 456 6270. Click here to download the enrollment form.

High wind speed and high rainfall exposure are the covered events, as recorded in the location identified in your policy document. You do not need to identify any physical property to be insured.

No. The insurance payout does not relate to actual experienced loss, but is tied to the amount of rain or the wind speed in a given event. Therefore, no on-the-ground assessment of property at risk is conducted prior to accepting a new client or prior to a payout.

The LPP is available throughout the year.

The insurance payout is made on the basis of the weather data reported by the independent calculation agents. There might be an instance where you could have experienced some loss, but there was no triggered payout because the rain and/or wind thresholds were not exceeded.

St Lucia is divided into two zones: North & South. The North Zone includes Gros Islet, Castries, Anse la Raye, Canaries and Dennery and the South Zone includes Soufriere, Choiseul, Laborie, Micoud and Vieux Fort.

Payout is based on the weather index (excess rainfall and high wind speed) measured and reported in the two zones.

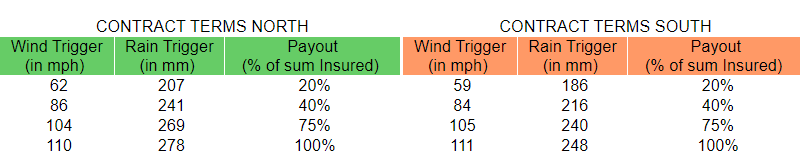

Each Zone has pre-defined thresholds, called trigger values, corresponding to different trigger levels and amount of payout (see tables below).

Once a trigger value is reached, the payout will be "triggered" automatically and be transferred to the client's bank account.

Once a trigger value is reached, the payout will be "triggered" automatically and be transferred to the client's bank account.

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

If the insured vehicle is out of use as a result of loss or damage insured under the policy we will indemnify you in respect of the necessary daily hiring charges incurred in obtaining a temporary replacement car from any recognized self drive hire operator. Subject to the policy terms and conditions.

The comprehensive policy automatically provides up to $3,000.00 coverage for accidental damage to glass and windscreen of the insured vehicle, with no applicable excess. If the insured wishes he/she can increase that amount to $5,000.00 and pay the appropriate additional premium.

If you and/or your spouse are injured while traveling in or getting into or out of any motor car we will pay to you or your legal representatives the compensation as specified in the policy.

4. Agreed Value Charge

The amount by which the insurer and insured agrees to insure the vehicle, without the deduction of depreciation should the vehicle be involved in an accident during the policy period. Should the vehicle be involved in an accident and the vehicle is considered a constructive total loss, the insurer would pay the insured value at the start of the current policy period.

5. Deductible/Excess

The first part of the loss which must be borne by the insured.

6. No Claims Discount

A discount an insurer agrees to provide the insured for that insured’s claim free driving experience. The no claim discount increases for every year the insured does have a claim. The maximum no claim discount one can enjoy is normally 60%.

EC Global Insurance Agency, Agents for GK Insurance (EC) Ltd will not contact its clients or anyone else by e-mail to confirm financial transactions, or to confirm or request personal account information or any other type of sensitive information.

Contact Us

1st Floor Financial Centre Building

Bridge Street,

Castries,

P O Box 1860,

Saint Lucia

Tel: (758) 451-3244Fax: (758) 458-1222

Email: information@ecglobalinsurance.com