FAQs

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

Proximate cause is the initial act or occurrence which sets off a natural, uninterrupted and continuous sequence of events that produces damage. In the absence of the initial occurrence which produces damage, no loss or damage would have resulted. Therefore when an insurance company asks you what was the proximate cause of house being burnt, they are not necessarily referring to the fire but what caused the fire.

It simply means that the person seeking coverage must stand to suffer financial loss as a result of the property being damaged. A homeowner will obviously suffer financial loss if his or her home burns down. You cannot, however, purchase insurance on your neighbor’s house and collect in the event the house burns as you do not have an insurable interest.

The right of the insurer to take over the insured’s rights following payment of a claim, to recover the payment from a third party responsible for the loss.

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

Your motor policy covers breakage of your windscreen or window up to a specified amount. There must be no other damage or injury apart from scratches caused by the shattering of the glass. Once this is the case the excess is not applicable and it will not affect your no claim discount.

This form is used by Insurers to gather information about the risk to be insured. For motor insurance some of the things insurers would be interested in are the person who owns the vehicle, the vehicle itself and the drivers. This will enable them to determine whether or not to accept a risk and the premium to charge. All the questions must, therefore, be answered truthfully and any material facts should be disclosed. A material fact is any information an Insurer would regard as likely to influence their assessment and acceptance of a risk.

Under the law, the Certificate of insurance is required as proof of the existence of insurance. It must be returned if the policy is suspended or cancelled. If it is lost, you should advise us immediately.

The law, which makes motor insurance compulsory, is called the Motor Vehicle Third Party Risks Law. The reference to third party is simply acknowledging that you have satisfied the legal requirements.

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

7. How much time do I have to buy additional insurance protection before an approaching hurricane?

Most insurance companies will not issue new homeowners coverage once an area has been placed under a hurricane watch or warning by the National Weather Service. This moratorium usually remains in effect for 48 hours after the watch/warning has lifted.

Make sure you have an adequate inventory of personal property. This inventory should include receipts, serial numbers, photographs and video tapes when possible. If your property is damaged by a hurricane, you should take all reasonable steps to protect it from further damage. Then prepare a list of all damaged and destroyed property.

- Your first official step is to fully complete our claim form and return same to your broker representative or us, ASAP but definitely within 30 days. The forms are available from your brokers, our office or web site.

- For contents, prepare an inventory of damaged / lost items available with date of purchase, purchase price, replacement cost or repair estimate.

- For building, have a detailed estimate from the person(s) you intend to have restore it.

- Make yourself available for claims adjuster.

- Allow at least one hour for adjuster to survey premises and take photos etc. (Have documents ready, e.g. site plan, claim documents).

- Make sure to point out all known damage.

- The adjuster will have local rates sheets for similar types of building repairs and will prepare his costing based on measurements taken by him.

- If his costing is in line with estimate / claim made by you the adjuster might request that you sign Proof of Loss Form which verifies that you accept the amount proposed to you by the adjuster as your loss.

- The adjuster will then send their report to us and we compare your loss with the policy coverage in place.

Info required about Damaged items:

- Item Description

- Year Purchased

- Original Cost

- Replacement Cost or Repair Cost

Indemnity or market value refers to an instance where a deduction is made for wear and tear. The amount which is paid is the amount required to replace the item with a replacement of the same age and in the same condition. This option however is rarely chosen and some insurers do not offer this type of cover.

The other option is new for old or reinstatement. Here the full cost of replacing the item as new is paid. Most insurers deduct a certain amount for wear and tear in certain circumstances; such as clothing and household linen. A deduction may also be made if the sum insured is inadequate or for property over a certain age.

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

The Livelihood Protection Policy (LPP) is targeted at all individuals and you are eligible regardless of your annual income or means of employment. To buy, contact your Credit Union or call EC Global Insurance Agency at 451 3244 or 456 6270. Click here to download the enrollment form.

High wind speed and high rainfall exposure are the covered events, as recorded in the location identified in your policy document. You do not need to identify any physical property to be insured.

No. The insurance payout does not relate to actual experienced loss, but is tied to the amount of rain or the wind speed in a given event. Therefore, no on-the-ground assessment of property at risk is conducted prior to accepting a new client or prior to a payout.

The LPP is available throughout the year.

The insurance payout is made on the basis of the weather data reported by the independent calculation agents. There might be an instance where you could have experienced some loss, but there was no triggered payout because the rain and/or wind thresholds were not exceeded.

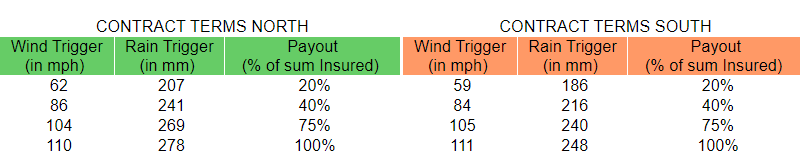

St Lucia is divided into two zones: North & South. The North Zone includes Gros Islet, Castries, Anse la Raye, Canaries and Dennery and the South Zone includes Soufriere, Choiseul, Laborie, Micoud and Vieux Fort.

Payout is based on the weather index (excess rainfall and high wind speed) measured and reported in the two zones.

Each Zone has pre-defined thresholds, called trigger values, corresponding to different trigger levels and amount of payout (see tables below).

Once a trigger value is reached, the payout will be "triggered" automatically and be transferred to the client's bank account.

Once a trigger value is reached, the payout will be "triggered" automatically and be transferred to the client's bank account.

Click on any question to get started. If your question isn't here, use the search box at the top of this page to search for topics. Should you have any further questions, please consult our Contact Us page.

If the insured vehicle is out of use as a result of loss or damage insured under the policy we will indemnify you in respect of the necessary daily hiring charges incurred in obtaining a temporary replacement car from any recognized self drive hire operator. Subject to the policy terms and conditions.

The comprehensive policy automatically provides up to $3,000.00 coverage for accidental damage to glass and windscreen of the insured vehicle, with no applicable excess. If the insured wishes he/she can increase that amount to $5,000.00 and pay the appropriate additional premium.

If you and/or your spouse are injured while traveling in or getting into or out of any motor car we will pay to you or your legal representatives the compensation as specified in the policy.

4. Agreed Value Charge

The amount by which the insurer and insured agrees to insure the vehicle, without the deduction of depreciation should the vehicle be involved in an accident during the policy period. Should the vehicle be involved in an accident and the vehicle is considered a constructive total loss, the insurer would pay the insured value at the start of the current policy period.

5. Deductible/Excess

The first part of the loss which must be borne by the insured.

6. No Claims Discount

A discount an insurer agrees to provide the insured for that insured’s claim free driving experience. The no claim discount increases for every year the insured does have a claim. The maximum no claim discount one can enjoy is normally 60%.

EC Global Insurance Agency, Agents for GK Insurance (EC) Ltd will not contact its clients or anyone else by e-mail to confirm financial transactions, or to confirm or request personal account information or any other type of sensitive information.

Contact Us

1st Floor Financial Centre Building

Bridge Street,

Castries,

P O Box 1860,

Saint Lucia

Tel: (758) 451-3244Fax: (758) 458-1222

Email: information@ecglobalinsurance.com